Erie Life Insurance Broker

Get Fast Free Life Insurance Quotes

Erie Life Insurance Broker

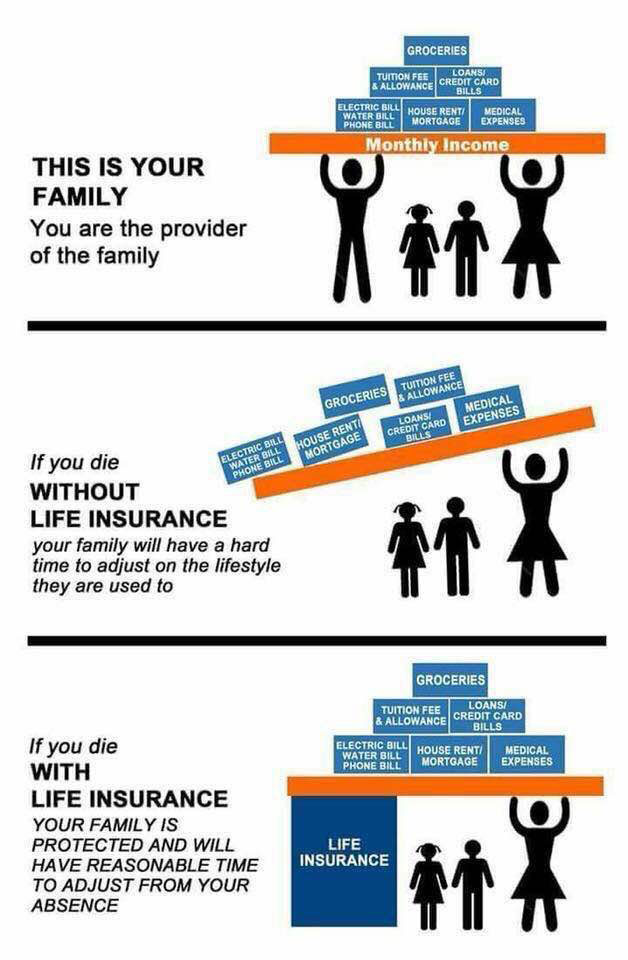

Life insurance is a great way to help prepare for life’s unexpected moments. Like most of us, you probably worry about the future. Can we pay off the house? Will my kids get a good education? Will they grow up healthy and happy?

With life insurance, you can know that no matter what tomorrow may bring, you can help support your family’s financial future.

The Mike Bissell Agency offers a full line of Life Insurance for newborns through 80 years of age. Life is all about options and choices and we will help answer those difficult questions and navigate you and your loved ones to the best policy.

With a variety of family insurance coverage options and products, you can find the coverage that you want for your needs.

The difference between worrying about the future and preparing for the future is doing something about it today. You deserve simple answers to your tough questions which you can find on the FAQs page, or request a life insurance quote now.

Do you know how much life insurance you need? Click the button below to download our handy spreadsheet made for our clients to help them figure out the accurate amount of life insurance they need.

What kind of life and family insurance fits my needs?

Term life insurance – policies generally offer the greatest amount of coverage for the lowest initial cost – they are the most straightforward form of coverage. If you have shorter-term needs and limited money to spend on insurance, a term life insurance policy may be the best fit for you.

Policyholders generally pay a premium on a monthly or annual basis for the length of that term. Proceeds help to cover financial responsibilities that decrease or end over time, like mortgages or car loans, should something happen to the insured. With term life policies, premiums will increase at the end of the fixed-term period.

Term life insurance policies are typically used to help provide additional life insurance coverage during child-raising years, to help pay for short-term debts, to help pay off a mortgage, or to fund a college education should the unexpected happen.

Whole life insurance – is a common type of permanent life insurance which combines level premiums with guaranteed death benefits. In addition, whole life insurance policies have guaranteed cash values which may be used by the policy owner to help support a variety of financial goals. They may produce excess credits which may be used to purchase additional paid-up life insurance, potentially increasing the available death benefit.

Whole life policies may also offer generally income tax-free loans and death benefits. For free whole life insurance quotes, fill out the form below.

Universal life insurance – as your life changes — marriage, parenthood, promotions, retirement — your insurance needs may change as well. To adapt to your ever changing life, and continue to meet your insurance needs, there’s universal life insurance.

Universal life is a variation of permanent life insurance that offers a wide variety of advantages. Like most permanent life insurance policies, universal life offers lifelong coverage, as long as all premiums are paid to keep the policy in force. However, universal life insurance also offers a considerable amount of flexibility and benefits to the policyholder, like:

- Flexible premiums and frequency of payments.

- Adjustable benefits and coverage levels.

- Potential cash value accumulation over time.

Thinking about life insurance?

Know you want life insurance?

Other Insurance Products

Our agency provides a wide range of insurance products to help customers with all their insurance needs. Why have several agents or online insurance companies that you can never get a hold of? Our agency is a one-stop shop for all of your insurance needs. Please feel contact us with any questions or concerns about your insurance.